For many people working in Ohio, especially those who dedicate their working years to public service, thinking about what comes next after a career is a really big deal. If you, or perhaps your life partner, have spent time working in Ohio and put money into systems like OPERS, STRS, or the School Employees Retirement System (SERS), you likely see this as a very important part of what will help you live comfortably later on. It is, in a way, a promise for your future financial well-being, giving a sense of calm about what lies ahead.

These systems, you know, are set up to give a sense of steadiness for many years. We are talking about things like the Ohio Public Employees Retirement System, which we often call OPERS, and also the State Teachers Retirement System, or STRS. Then, there is the School Employees Retirement System, SERS, which is a big topic for many who work in schools across our state. They are, in essence, cornerstones for countless individuals and their households, providing a solid base for life once work slows down.

We have heard, too, from groups like the Ohio Association of Public School Employees, often called OAPSE, that there have been quite a few inquiries about some of the more recent adjustments made to the School Employees Retirement System of Ohio, which is SERS. We really want to make sure that everyone who is a part of OAPSE gets the information they need to feel good about what is happening with their retirement plans. It is, basically, about keeping everyone in the loop and making sure no one feels left out of the conversation about something so vital to their long-term plans.

- Vnc Authentication Failed Too Many Security Failures

- How To Use Access Raspberry Pi Behind Router

- Securely Connect Remoteiot P2p Ssh Download Android

- एसएसएच एकसस आईओट उदहरण

- Is Lalah Hathaway Donny Hathaways Daughter

Table of Contents

- Understanding Your Ohio SERS Plan

- What Is a Defined Benefit Plan, and How Does It Affect Ohio SERS Members?

- How Does Ohio SERS Support You Beyond a Pension?

- Connecting Ohio SERS with Other Income Sources

- Ohio SERS and Your Healthcare Choices

- What About Deferred Compensation and Ohio SERS?

- How Does Ohio SERS Relate to School Employees' Interests?

- Staying Informed About Your Ohio SERS Benefits

Understanding Your Ohio SERS Plan

When we talk about the School Employees Retirement System, or SERS, in Ohio, we are really discussing a specific kind of retirement arrangement. This system is what people call a defined benefit plan. What this means for you, in a very straightforward way, is that the plan makes a promise. It promises you a regular payment for the rest of your life once you retire. This payment, you see, is not something that changes based on how the stock market is doing or other outside things. Instead, it is a fixed amount that you can count on, which is quite a comforting thought for many people looking ahead to their later years.

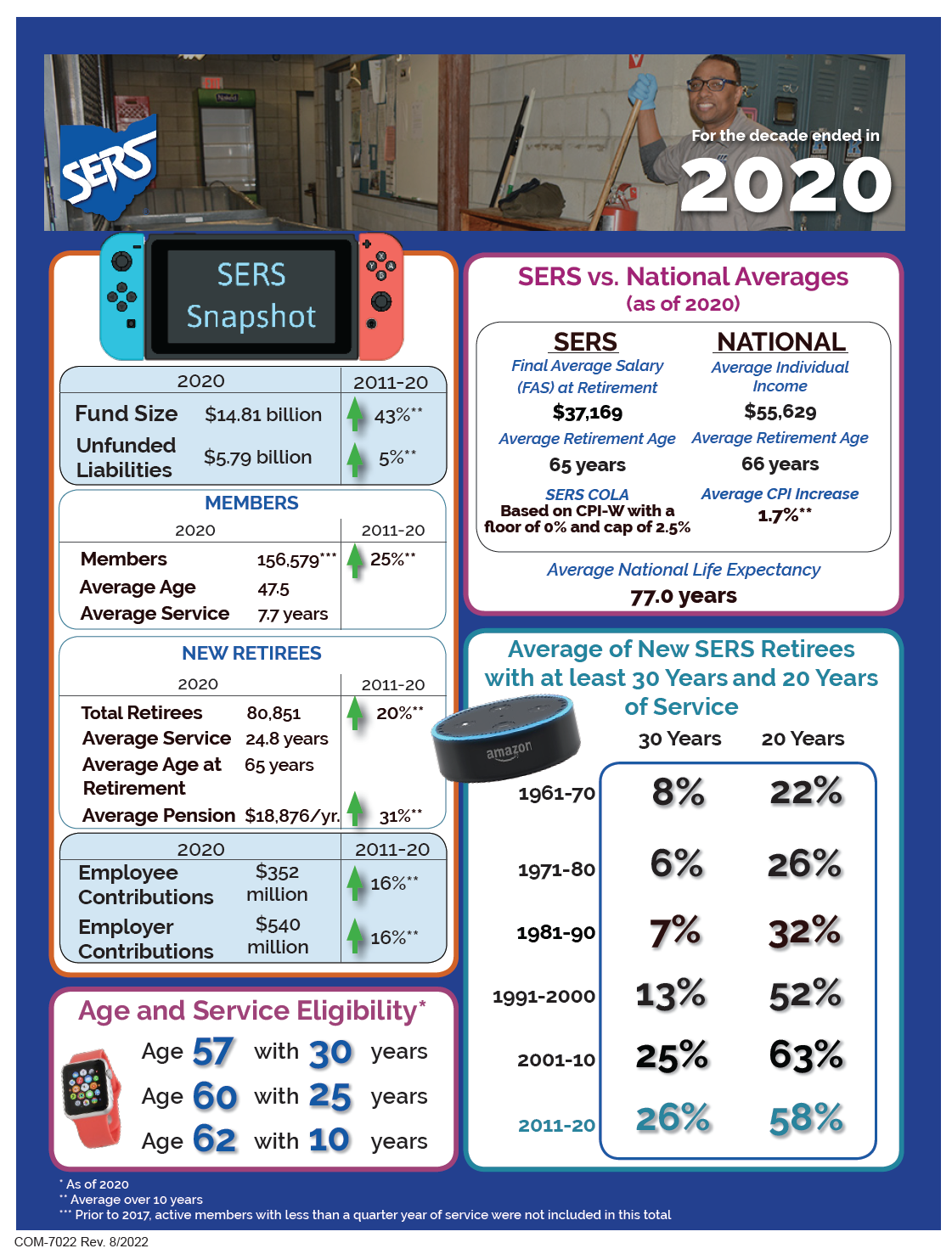

The amount of money you get each month from SERS, you know, is figured out using a few key pieces of information about your working life. First, your age plays a part when you decide to stop working. Then, there is your final average salary, which basically looks at how much you were earning during your last few years on the job. And, perhaps most importantly, the number of years you have put in service also helps shape that final number. So, in some respects, the longer you have worked and the more you have earned, the better your retirement income from SERS tends to be, which makes a lot of sense for people who have dedicated their lives to working in schools.

It is, basically, a system that rewards steady work and commitment over time. This structure is quite different from other retirement plans where you might have to guess how much money you will have when you stop working, or where the amount depends on how well your investments perform. With SERS, you have a much clearer picture of what to expect, which can help you plan your future with a good deal more certainty. That, you know, is a very important part of feeling ready for retirement, knowing that a steady income stream will be there for you.

- Barron Trump On America Has Talent

- Remote Ssh Login Iot Password

- Does Barron Trumpsing

- Vpc Pricing

- Ssh Raspberry Pi Iot Device Tutorial

What Is a Defined Benefit Plan, and How Does It Affect Ohio SERS Members?

So, we mentioned that SERS is a defined benefit plan. What does that truly mean for someone who is a part of the School Employees Retirement System of Ohio? Well, it is a bit like having a promise written down, guaranteeing you a regular payment once you are no longer working. This payment is set in stone, based on those factors we just talked about: your age when you retire, the average of your last few years of earnings, and how many years you have spent working. It is not, say, a fund where you put money in and then hope it grows enough; it is a commitment from the system to give you a specific amount each month for the rest of your life.

This kind of plan, you know, offers a very different feeling of security compared to, for example, a 401(k) or a 403(b), which are often called defined contribution plans. With those, you put money in, and the amount you get out depends on how your investments perform. If the market goes down, your retirement savings could shrink. But with a defined benefit plan like SERS, the risk is mostly on the system, not on you. They are the ones who have to make sure there is enough money to pay everyone what they are owed, which, in a way, gives you a lot more peace of mind about your future income.

For someone who has spent their working life in a school setting, knowing that a steady, predictable income will arrive each month after they retire is, quite honestly, a huge comfort. It means you can plan your budget, figure out your living expenses, and generally just enjoy your later years without constantly worrying about money. It is, basically, a fundamental piece of your financial picture, helping to make sure your retirement years are comfortable and free from major money worries. This stability is, very, very often, what people are looking for when they think about their long-term financial plans.

How Does Ohio SERS Support You Beyond a Pension?

Now, SERS in Ohio is not just about giving you a regular payment when you stop working. It actually serves two really important purposes for its members. First, it is, of course, a pension fund, making sure you have that steady income stream we have been talking about. But then, it also acts as a disability insurance program, which is something many people might not think about right away. This dual role means that SERS is there for you not just when you reach retirement age, but also if something unexpected happens during your working years that prevents you from doing your job.

Imagine, for a moment, that you are working hard, putting in your time, and then, sadly, something happens that leaves you unable to continue your work in the same way. This is where the disability insurance part of SERS comes into play. It is, essentially, a safety net. If you qualify, this program can provide you with financial help when you are unable to earn a living due to a disabling condition. This means you are not left completely without support during a very difficult time, which is, honestly, a huge relief for anyone facing such a situation. It is, very, very much, about providing a sense of security.

So, while the pension aspect is what most people focus on when they think about retirement, the disability insurance side of SERS is just as important for protecting your financial well-being during your working life. It is a comprehensive approach to supporting school employees, looking out for them both in their later years and if unforeseen challenges come up. This broad coverage is, in a way, one of the more valuable features of being a SERS member, giving you peace of mind that you are covered for more than just your retirement years. It is, truly, a system that looks out for its people in more ways than one.

Connecting Ohio SERS with Other Income Sources

A question that often comes up for people in Ohio, especially those who are part of SERS, is how their SERS benefits fit in with other sources of income, particularly Social Security. It is, you know, a common concern because many people count on both of these for their financial stability later in life. The good news is that Ohio residents can, in fact, receive both SERS benefits and Social Security benefits. This is possible if they meet the requirements for both programs, which is a pretty big deal for many households planning their financial future.

The ability to get money from both SERS and Social Security means that you can potentially have a stronger, more reliable stream of income once you stop working. Social Security, you know, has its own set of rules about how many work credits you need and at what age you can start receiving payments. SERS, as we have talked about, has its own rules based on your age, earnings, and years of service. If you have worked enough under both systems to qualify, then you can, basically, get payments from both, which really helps to build a solid financial base for your retirement years. It is, in some respects, like having two pillars supporting your financial house.

This dual eligibility is something that many people find comforting, as it offers a greater sense of financial stability. It means you are not putting all your eggs in one basket, so to speak. Instead, you have different sources of income contributing to your overall financial health in retirement. This can make a real difference in how comfortably you live and what kinds of things you can do once your working days are behind you. It is, truly, a valuable aspect of retirement planning for those who qualify for both types of support.

Ohio SERS and Your Healthcare Choices

As people get closer to their retirement years, one of the biggest things on their minds, beyond just income, is often healthcare. It is, basically, a very important part of staying well and enjoying your later life. For those connected with the School Employees Retirement System of Ohio, or SERS, understanding how SERS works with Medicare to help with healthcare choices for people who have retired is a really key piece of information. This connection is, you know, about making sure you have good options for staying healthy once you are no longer working.

Learning about this connection means looking into how SERS might help you with your medical costs once you are eligible for Medicare. Medicare, as you might know, is the federal health insurance program for people who are 65 or older, and also for some younger people with certain conditions. SERS, in its own way, offers programs or assistance that can work alongside Medicare to give you more complete coverage. This could involve, for instance, supplemental plans that help cover costs Medicare does not, or perhaps other arrangements that make healthcare more affordable for retirees. It is, very, very often, about finding the best combination for your personal needs.

To get a handle on all of this, you will want to look at things like what benefits are available, who can get them, and how you go about signing up. The goal is to make this process as simple as possible, giving you a clear guide to follow. Having a clear picture of your healthcare options through SERS and Medicare can really take a lot of worry off your shoulders, letting you focus on enjoying your retirement rather than stressing about medical bills. It is, essentially, about providing a pathway to good health coverage for those who have served in Ohio's schools.

What About Deferred Compensation and Ohio SERS?

When we talk about saving for retirement, sometimes other terms come up, like "deferred compensation." It is, basically, another way that people in Ohio, especially those working for the state or in public service, can put money aside for their future. While SERS is a defined benefit pension plan, deferred compensation plans are a bit different. These are often plans where you choose to have a part of your pay set aside before taxes are taken out, and that money then grows over time. It is, you know, a way to save extra for retirement on top of your pension.

Ohio has various deferred compensation retirement systems. We see them, for example, with the Ohio Public Employees Retirement System, which is OPERS, and even for those in the Highway Patrol Retirement System, known as HPRS. These plans give people more ways to save, offering flexibility and control over their own investment choices. While your SERS pension provides a guaranteed income, a deferred compensation plan allows you to build up additional savings that you can access later on. It is, in some respects, about giving you more options for building your financial nest egg.

So, for many people, combining their SERS pension with a deferred compensation plan can create a really strong financial picture for retirement. The pension provides that steady, predictable base, and the deferred compensation offers an extra layer of savings that you have more direct influence over. This combination can give you a greater sense of security and more choices about how you live once you stop working. It is, truly, about giving you the tools to shape the retirement you want for yourself.

How Does Ohio SERS Relate to School Employees' Interests?

For those who work in Ohio's schools, whether they are teachers, administrators, or support staff, groups like the School Employees Retirement Organization, or SERO, play a really important part. SERO, you know, works to look after the concerns and overall well-being of Ohio’s school employees. This means they are often speaking up for the people who are part of systems like SERS, making sure their voices are heard when decisions are being made that could affect their future.

One of the main things SERO does is help school employees learn more about things that matter to them. This includes, for instance, keeping them up to date on any proposed laws that could change their benefits or working conditions. They also keep an eye on what is happening with pension trends, so people understand how their retirement plans might be affected by broader changes. It is, basically, about giving people the information they need to feel knowledgeable and secure about their future. This kind of work is, very, very important for keeping members informed and empowered.

By promoting the interests of school employees, SERO helps ensure that the SERS system continues to serve its members well. They are, in a way, a bridge between the employees and the decisions that shape their retirement and working lives. This focus on education and advocacy means that school employees have a dedicated group looking out for their best interests, which can be a real comfort for those who are counting on their SERS benefits for their later years. It is, truly, about collective support for a shared future.

Staying Informed About Your Ohio SERS Benefits

Keeping up to date with your SERS benefits is, you know, a very important part of planning for your future. Things can change, and new information might come out that affects your pension or other parts of your retirement plan. That is why groups like OAPSE, the Ohio Association of Public School Employees, work hard to make sure their members are well-informed. They want to ensure that everyone who is part of OAPSE has the latest details about any adjustments or news concerning the School Employees Retirement System of Ohio.

This means paying attention to communications from SERS itself, and also from organizations that represent your interests, like OAPSE or SERO. They often provide updates on things like changes to benefit rules, information about eligibility, and details on how to enroll in certain programs, such as those related to healthcare. It is, basically, about being proactive and taking the time to understand the specifics of your plan. This effort, in some respects, pays off by giving you a clear picture of what you can expect.

Having a good grasp of your SERS benefits, including how they work with other programs like Social Security and Medicare, can help you make smart choices for your retirement. It is, very, very much, about being prepared and feeling confident about your financial situation when you decide to stop working. By staying informed, you can ensure that your SERS plan remains a strong and reliable part of your retirement income, giving you the peace of mind you deserve after a career dedicated to Ohio's schools.

The School Employees Retirement System of Ohio, or SERS, plays a very important role for many people who have worked in schools across the state. It is a defined benefit plan, which means it offers a guaranteed lifetime pension based on your age, final average salary, and years of service. Beyond just a pension, SERS also works as a disability insurance program, providing a safety net if you are unable to work due to a disabling condition. Ohio residents can often receive both SERS benefits and Social Security benefits if they meet the requirements for both. SERS also connects with Medicare to offer healthcare options for people who have retired. Organizations like SERO and OAPSE work to support school employees, keeping them informed about legislative changes and pension trends. Understanding how SERS works, including its benefits, eligibility, and enrollment details, is key for planning a secure retirement. It is, basically, about knowing your options and how to make the most of this vital system for your future.

Related Resources:

Detail Author:

- Name : Laurine Baumbach

- Username : tmonahan

- Email : genoveva73@hotmail.com

- Birthdate : 1972-09-15

- Address : 950 Witting Trafficway Walshfort, NY 31835-9095

- Phone : (712) 872-1917

- Company : Zemlak, Champlin and Pouros

- Job : Artillery Crew Member

- Bio : Recusandae molestiae in maxime dolores adipisci perferendis illum. Vel fugiat eligendi sequi nam aut.

Socials

linkedin:

- url : https://linkedin.com/in/tyra.dietrich

- username : tyra.dietrich

- bio : Perferendis unde mollitia eaque ipsa.

- followers : 1250

- following : 2133

facebook:

- url : https://facebook.com/tyra4571

- username : tyra4571

- bio : Veritatis ipsam est dolorem placeat. Sit non ullam incidunt ab.

- followers : 6310

- following : 509

twitter:

- url : https://twitter.com/tyra.dietrich

- username : tyra.dietrich

- bio : Sint quia praesentium qui aspernatur aut ipsum. Dolores sed voluptatem iste. Fuga corrupti vitae dolorem.

- followers : 879

- following : 2827

instagram:

- url : https://instagram.com/tdietrich

- username : tdietrich

- bio : Expedita porro possimus deleniti et. Qui non in doloribus voluptatem.

- followers : 1254

- following : 1368

tiktok:

- url : https://tiktok.com/@dietricht

- username : dietricht

- bio : Distinctio qui voluptates tempore eum est a labore.

- followers : 6997

- following : 1621